This Policy outlines the University philosophy on debt, establishes the framework for approving, managing, and reporting debt and provides debt management guidelines.

I. Policy Statement

The mission of The University of North Carolina at Charlotte (University) is supported by the development and implementation of the long-term strategic plan. The strategic plan establishes University-wide priorities and programmatic objectives. The University develops a capital plan to support these priorities and objectives.

The University’s use of debt plays a critical role in ensuring adequate and cost effective funding for the capital plan. By linking the objectives of its Debt Policy to its strategic objectives, the University ultimately increases the likelihood of achieving its mission.

This Debt Policy is intended to be a dynamic document that will evolve over time to meet the changing needs of the University.

A. Scope

This Debt Policy applies to the University and affiliated entities and covers all forms of debt including long-term, short-term, fixed-rate, and variable-rate debt. It also covers other forms of financing including both on-balance sheet and off-balance sheet structures, such as leases, and other structured products used with the intent of funding capital projects.

The use of derivatives is not covered under this policy. When the use of derivatives is being considered a separate Interest Rate Risk Management policy will be drafted.

B. Objectives

The objectives of this policy are to:

- Outline the University’s philosophy on debt

- Establish a control framework for approving and managing debt

- Define reporting guidelines

- Establish debt management guidelines

This Debt Policy formalizes the link between the University’s Strategic Plan and the issuance of debt. Debt is a limited resource that must be managed strategically in order to best support University priorities.

The policy establishes a control framework to ensure that appropriate discipline is in place regarding capital rationing, reporting requirements, debt portfolio composition, debt servicing, and debt authorization. It establishes guidelines to ensure that existing and proposed debt issues are consistent with financial resources to maintain an optimal amount of leverage, a strong financial profile, and a strategically optimal credit rating.

Under this policy, debt is being managed to achieve the following goals:

- Maintaining access to financial markets: capital, money, and bank markets.

- Managing the University’s credit rating to meet its strategic objectives while maintaining the highest acceptable creditworthiness and most favorable relative cost of capital and borrowing terms;

- Optimizing the University’s debt mix (i.e., short-term and long-term, fixed-rate and floating-rate) for the University’s debt portfolio;

- Managing the structure and maturity profile of debt to meet liquidity objectives and make funds available to support future capital projects and strategic initiatives;

- Coordinating debt management decisions with asset management decisions to optimize overall funding and portfolio management strategies.

The University may use debt to accomplish critical priorities by more prudently using debt financing to accelerate the initiation or completion of certain projects, where appropriate. As part of its review of each project, the University evaluates all funding sources to determine the optimal funding structure to achieve the lowest cost of capital.

II. Roles and Responsibilities; Compliance

The Office of the Vice Chancellor for Business Affairs (“VCBA”) is responsible for implementing this policy and for all debt financing activities. The policy and any subsequent, material changes to the policy must be approved by the Chancellor after consultation with the University’s Board of Trustees (“BOT”.) The approved policy provides the framework under which debt management decisions are made.

The exposure limits listed in the policy are monitored on a regular basis by Treasury Services. The office of the VCBA reports regularly to the Chancellor and the BOT on the University’s debt position and plans.

III. Procedures

A. Debt Affordability and Capacity

In assessing its current debt levels and when planning for additional debt, the University takes into account both its debt affordability and debt capacity. Debt affordability focuses on the University’s ability to service its debt through its operating budget and identified revenue streams and is driven by strength in income and cash flows. Debt capacity focuses on the University’s financial leverage in terms of debt funding as a percentage of the University’s total capital.

The University considers many factors in assessing its debt affordability and debt capacity including its strategic plan, market position, and alternative sources of funding. The University uses four key quantitative ratios to inform its assessments with respect to debt affordability and debt capacity.

The ratios described below are not intended to track a specific rating, but rather to help the University maintain a competitive financial profile and funding for facilities needs and reserves.

This Debt Policy is shared with external credit analysts and other parties to provide them with background on the University’s philosophy on debt and management’s assessment of debt capacity and affordability.

1. Debt Affordability Measures

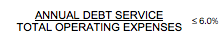

a. Debt Burden Percentage

This ratio measures the University’s debt service burden as a percentage of total university expenses. The target for this ratio is intended to maintain the University’s long-term operating flexibility to finance existing requirements and new initiatives.

The measure is based on aggregate operating expenses as opposed to operating revenues because expenses typically are more stable (e.g. revenues may be subject to one-time operating gifts, investment return fluctuations, variability of State funding, etc.) and better reflect the operating base of the University. This ratio is adjusted to reflect any non-amortizing or non-traditional debt structures that could result in significant single year fluctuations including the effect of debt refundings.

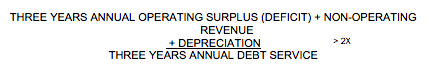

b. Average Debt Service Coverage Ratio

This ratio measures the University’s ability to cover debt service requirements from adjusted net operating income. This calculation is a three-year average of income compared to actual debt services on capital debt. The target established is intended to ensure that operating revenues are sufficient to meet debt service requirements and that debt service does not consume too large a portion of income.

This ratio is adjusted to reflect any non-amortizing or non-traditional debt structures that could result in significant single year fluctuations including the effect of debt refundings.

2. Debt Capacity Measures

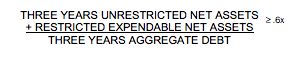

a. Average Viability Ratio

This ratio indicates one of the most basic determinants of financial health by measuring the three year average availability of liquid and expendable net assets to the three year average aggregate debt. The ratio measures the medium to long-term health of the University’s balance sheet and debt capacity and is a critical consideration of universities with the highest credit quality.

Many factors influence the viability ratio, affecting both the assets (e.g., investment performance, philanthropy) and liabilities (e.g., timing of bond issues), and therefore the ratio is best examined in the context of changing market conditions so that it accurately reflects relative financial strength.

b. Debt Capitalization Ratio

This ratio measures the percentage of University capital that comes from debt. A university that relies too heavily on debt capital may risk being over-leveraged and potentially reduce its access to capital markets. Conversely, a university that does not strategically utilize debt as a source of capital may not be optimizing its funding mix, thereby sacrificing access to low-cost funding to invest in mission objectives.

Both the Viability and Debt Capitalization Ratios include any component unit (University-related foundation) balances as disclosed in the University’s financial statements.

B. Financing Sources

The University recognizes that there are numerous types of financing structures and funding sources available, each with specific benefits, risks, and costs. All potential funding sources are reviewed by management within the context of this Debt Policy and the overall portfolio to ensure that any financial product or structure is consistent with the University’s objectives. Regardless of what financing structure(s) are utilized, due-diligence review must be performed for each transaction, including (i) quantification of potential risks and benefits; and (ii) analysis of the impact on University creditworthiness and debt affordability and capacity.

1. Tax-Exempt Debt

The University recognizes that tax-exempt debt is a significant component of the University’s capitalization due in part to its substantial cost benefits; therefore, tax-exempt debt is managed as a portfolio of obligations designed to meet long-term financial objectives rather than as a series of discrete financings tied to specific projects. The University manages the debt portfolio to maximize its utilization of tax-exempt debt relative to taxable debt whenever possible. In all circumstances, however, individual projects continue to be identified and tracked to ensure compliance with all tax and reimbursement regulations.

For tax-exempt debt, the University considers maximizing the external maturity of any tax-exempt bond issue, subject to prevailing market conditions and opportunities and other considerations, including applicable regulations.

2. Taxable Debt

In instances where certain of the University’s capital projects do not qualify for tax-exempt debt, the use of taxable debt may be considered. The taxable debt market offers certain advantages in terms of liquidity and marketing efficiency; such advantages will be considered when evaluating the costs and benefits of a taxable debt issuance.

3. Commercial Paper

Commercial paper provides the University with interim financing for projects in anticipation of philanthropy or planned issuance of long-term debt. The use of commercial paper also provides greater flexibility on the timing and structuring of individual bond transactions. This flexibility also makes commercial paper appropriate for financing equipment and short-term operating needs. The University recognizes that the amount of commercial paper is limited by this Debt Policy ratios, the University’s variable-rate debt allocation limit, and the University’s available liquidity support.

4. University-issued vs. State-Issued Debt

In determining the most cost effective means of issuing debt, the University evaluates the merits of issuing debt directly vs. participating in debt pools through the UNC System Board of Governors. On a regular basis, the University performs a cost/benefit analysis between these two options and takes into consideration the comparative funding costs, flexibility in market timing, and bond ratings of each alternative. The University also takes into consideration the future administrative flexibility of each issue such as the ability to call and/or refund issues at a later date, as well as the administrative flexibility to structure and manage the debt in a manner that the University believes to be appropriate and in the University’s best interest.

5. Other Financing Sources

Given limited debt capacity and substantial capital needs, opportunities for alternative and non-traditional transaction structures may be considered. The University recognizes these types of transactions often can be more expensive than traditional University debt structures; therefore, the benefits of any potential transaction must outweigh any potential costs.

All structures may be considered only when the economic benefit and the likely impact on the University’s debt capacity and credit have been determined. Specifically, for any third-party or developer-based financing, management ensures the full credit impact of the structure is evaluated and quantified.

C. Portfolio Management of Debt

The University considers its debt portfolio holistically to optimize the portfolio of debt for the entire University rather than on a project-by-project basis while taking into account the University’s cash and investment portfolio (see Appendix A). Therefore, management makes decisions regarding project prioritization, debt portfolio optimization, and financing structures within the context of the overall needs and circumstances of the University.

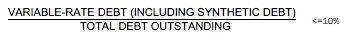

1. Variable-Rate Debt

The University recognizes that a degree of exposure to variable interest rates within the University’s debt portfolio might be desirable in order to:

- take advantage of repayment/restructuring flexibility;

- benefit from historically lower average interest costs;

- provide a “match” between debt service requirements and the projected cash flows from the University’s assets; and

- diversify its pool of potential investors.

Management monitors overall interest rate exposure, analyzes and quantifies potential risks, including interest rate, liquidity and rollover risks, and coordinates appropriate fixed/variable allocation strategies. The portfolio allocation to variable-rate debt may be managed or adjusted through (i) the issuance or redemption of debt in the conventional debt market (e.g. new issues and refundings) and (ii) the use of interest rate derivative products including swaps.

The amount of variable-rate debt outstanding (adjusted for any derivatives) shall not exceed 10% of the University’s outstanding debt. This limit is based on the University’s desire to: (i) limit annual variances in its interest payments; (ii) provide sufficient structuring flexibility to management; (iii) keep the University’s variable-rate allocation within acceptable external parameters; and (iv) utilize variable-rate debt (including derivatives) to optimize debt portfolio allocation and minimize costs.

2. Refinancing Outstanding Debt

The University monitors its debt portfolio on a continual basis to assure portfolio management objectives are being met and to identify opportunities to lower its cost of funding, primarily through refinancing outstanding debt. The University of North Carolina General Administration prefers a savings of 2% for refinancing current outstanding debt. Savings requirements in excess of 2% may be required from time to time by the Vice Chancellor for Business Affairs.

The University monitors the prices and yields of its outstanding debt and attempts to identify potential refunding candidates by examining refunding rates and calculating the net present value of any refunding savings after taking into account all transaction costs. The University may choose to pursue refundings for economic and/or legal reasons. The University reserves the right to not partially refund an issue.

3. Liquidity Requirements

If the University’s portfolio includes variable-rate debt and commercial paper, liquidity support is required in the event of the bonds or paper being put back to the University by investors. Generally, the University can purchase liquidity support externally from a bank in the form of a standby bond purchase agreement or line of credit. In addition, the University may consider using its own capital in lieu of or to supplement external liquidity facilities. Alternatively, it may utilize variable-rate structures that do not require liquidity support (e.g. auction-rate products.)

Just as the University manages its debt on a portfolio basis, it also manages its liquidity needs by considering its entire asset and debt portfolio, rather than managing liquidity solely on an issue-specific basis. This approach permits institution-wide evaluation of desired liquidity requirements and exposure, minimizes administrative burden, and reduces total liquidity costs.

A balanced approach may be used to provide liquidity support to enhance credit for variable-rate debt, through a combination of external bank liquidity, auction market or derivative structures. Using a variety of approaches limits dependence on an individual type or source of credit; it also allows for exposure to different types of investors. The University must balance liquidity requirements with its investment objectives and its cost and renewal risk of third-party liquidity providers.

Further, a portfolio-approach to liquidity can enhance investment flexibility, reduce administrative requirements, lower total interest costs, and reduce the need for external bank liquidity.

4. Overall Exposure

The University recognizes that it may be exposed to interest rate, third-party credit, and other potential risks in areas other than direct University debt (e.g., counterparty exposure in the investment portfolio, etc.) and, therefore, exposures are considered on a comprehensive University-wide basis.

D. Strategic Debt Allocation

Recognizing that financial resources are not sufficient to fund all capital projects, management must allocate debt strategically, continuing to explore alternate sources of funding for projects. External support, philanthropy, and direct State investment remain critical to the University’s facilities investment plan.

Management allocates the use of debt financing internally within the University to reflect the prioritization of debt resources among all uses, including plant and equipment financing, academic projects, and projects with institutional impact. Generally, the University favors debt financing for those projects critical to the attainment of its strategic goals and those projects with identified revenue streams for the repayment of debt service and incremental operating costs.

Each capital project is analyzed at its inception to ensure that capital is used in the most effective manner and in the best interests of the University. There is an initial institutional review of each project, prior to its inclusion in the capital plan, to determine if debt leveraging would be desirable even if not requested by the project sponsor.

As part of this initial institutional review, the University also will assess, based on the project’s business plan, the sufficiency of revenues to support any internal loans. If the University determines that collateral is necessary, it may require the entity to segregate unrestricted funds for this purpose.

E. Debt Administration and Other Matters

The issuance of tax-exempt debt generally requires the aid and assistance of several outside parties:

- Use of a financial advisor is recommended with a competitive selection process at least once every five years.

- Bond counsel appointments are competitively determined at least once every five years.

- The selection of underwriters is recommended for each debt issuance using a competitive process. Co-managers are recommended for issuances of $30 million or more and will be selected from the same group of underwriters responding to the competitive bid process.

Debt issuance can be “sized” to include capitalized interest and borrowing costs up to 5% of the debt issuance.

Reimbursement resolutions will be prepared for each debt issuance.

Financial Services is responsible for developing, managing, and complying with debt requirements, including timely debt service payments, post-issuance compliance, private business use analysis, and records retention.

F. Approval Process

All debt issued is by the authority granted to the UNC System Board of Governors under N.C.G.S. § 116D, Article 3. All debt issue is approved by the UNC Charlotte Board of Trustees and then by the UNC System Board of Governors.

When the University participates in bond programs that are administered by the State, including State tax supported debt, such bonds are issued by the State Treasurer, who also possesses the authority to price such bonds.

- Initially approved February 2, 2015

- Updated February 21, 2019

Authority: Chancellor

Responsible Office: Business Affairs